|

[VIEWED 22076

TIMES]

|

SAVE! for ease of future access.

|

|

The postings in this thread span 5 pages, go to PAGE 1.

This page is only showing last 20 replies

|

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-20-06 9:53

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Thought some of you might find this article on financial services firms interesting: From The Economist Investment banks Coining it Dec 20th 2006

From Economist.com American securities firms have had a bumper year

IT HAS been a year to make even Croesus blush for the big Wall Street securities firms. Goldman Sachs, Bear Stearns, Morgan Stanley and Lehman Brothers have all announced record profits and beaten analysts’ expectations in the process. Bloomberg, a financial-information firm, calculates that the industry will make $29.1 billion after tax in fiscal 2006, a 43% rise on last year, which was itself a bumper one. New York’s tabloids have had a field day, splashing headlines like “Sachs of Loot†and fantasising about all the things outsized bonuses could buy.

Goldman, the best performer, is setting aside an unprecedented $16.5 billion to reward its talent, equal to $620,000 per employee across the firm. But it is now so profitable that the ratio of pay to revenue has actually fallen, to 43.7%, well below the 50% seen as a ceiling in the industry. And on Tuesday November 19th Goldman revealed that the bank’s boss, Lloyd Blankfein, would pocket $53.4m this year. This paypacket broke an industry record set only last week at Morgan Stanley—its chief, John Mack, will get around $40m for his work in 2006. The huge sums of cash and the attendant publicity prompted Mr Blankfein to call for humility as his troops reflect on their stellar year.

Even if some bankers do exercise a little modesty when it comes to spending their vast earnings this is unlikely to dampen the mood of purveyors of luxury goods and fancy homes, who hope to pick up more than a few crumbs from Wall Street’s table. Orders for bespoke suits are up on last year, says Jack Mitchell, who kits out some of Wall Street's financial bigwigs. New York officials are delighted, too. They have slashed the city’s budget-deficit forecast, in part because of the sharp rise in tax receipts from investment banks.

The banks can thank near-perfect markets for their good fortune. Mergers and private equity are booming, as are stockmarkets (the Dow Jones Industrial Average hit another record high on Tuesday). Volatility is low, credit still plentiful. Hedge funds and others are trading derivatives at a furious pace, providing a further lift to the banks’ prime-brokerage businesses. In these conditions, the banks have (so far) profited handsomely from ratcheting up their own risk-taking. Across the industry, value-at-risk—a measure of potential losses on a bad trading day—has risen steadily. Some 70% of Goldman’s net revenues now come from trading and investing on its own account.

Everyone knows this cannot last forever. The banks are hoping that their scope will help them when markets turn. Growth prospects look good in Asia and Europe, and all of the leading firms apart from Bear Stearns now do a big chunk of their business outside America. They are also beefing up their distressed-debt and bankruptcy teams, a source of profit that should mitigate any pain from a rise in defaults and tougher debt markets.

But with investment banks outperforming their commercial-banking counterparts on almost every measure, including share price, the gloating will be hard to contain. Just now, much of it is directed at Citigroup, which is under pressure to cut costs and raise its share price. Strikingly, the financial conglomerate is paying slightly higher interest on its five-year debt than Lehman or Bear Stearns.

Moreover, any investment banker worth his salt will tell you that there is not much money in meekness. After a day or two reacquainting themselves with their families at Christmas, most will race back to their desks next week, hungry to make another killing.

|

| |

|

|

The postings in this thread span 5 pages, go to PAGE 1.

This page is only showing last 20 replies

|

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-26-06 9:57

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I'm not in one of the top 10 schools. I'm far from there. So I guess I'll just try my luck in I-Banking. Besides, if I do get into I-banking my chances of making money seem more than in derivaties modelling. And screw PhD. Don't have time for all that. :D Thanks eminitrader. TT

|

| |

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-26-06 9:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Never invest in one basket and never believe in such hyped up selling that promises over 30% per annum as ROI. You can invest in any investment providing in generates in average more then your bank is giving you. " I agree completley about diverifying and deciding what rate of return you want to sell at (as hard as that might be to do sometimes.) As for 30%, yes, that is a high rate of return for the US markets. You need to make your own decisions about what you are buying and how much risk you want to put your money at. Of course, if you you look at these two India funds,for example, the story for the last one year, has been a bit different : ETGIX

Eaton Vance Grtr Ind;A MINDXMatthews Asian:India Again, these come with their risks and I can only people will weigh those in when making their decisions.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-26-06 9:58

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Oh, and how did you get into trading forex? Is this your hobby or your career? Just curious. It'd be so cool to have a society of Nepali Finance Professionals. NFP. YIA! TT

|

| |

|

|

Captain Haddock

Please log in to subscribe to Captain Haddock's postings.

Posted on 12-26-06 11:33

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

The Journal Report on alternative investments outside of stocks and bonds for the individual investor. Talks about commodities and hedge funds investments. Thought I'd post this based on some of the comments so far.

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-26-06 3:48

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

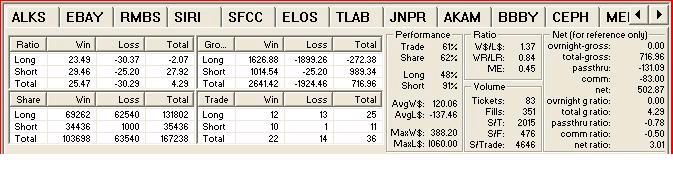

Not bad for a slow day.

|

| |

|

|

redstone

Please log in to subscribe to redstone's postings.

Posted on 12-26-06 5:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Slow day it is. Freakin slow. I won't be able to trade until tomorrow night, coz of work. I wouldn't say its my hobby or a full time job. Its just what i do, call it a part time job! :) 88 pips down since open, and i was away. just got home, so no profit in my bag. here is todays GBP/USD image :)

|

| |

|

|

DUKE1

Please log in to subscribe to DUKE1's postings.

Posted on 12-26-06 10:46

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Although some retracement is taking place; long term trend is intact. I am long at 1.9552 with stop 19.24. target 1.9650 Fib 38.2 is farway down to 93.29 but is reachable. Looking good so far; strategy Buy on the dips! Tight stop is neccessary as retracement levels are nearing. N.B the bottom trend line is slightly off! Risks see RSI

|

| |

|

|

DUKE1

Please log in to subscribe to DUKE1's postings.

Posted on 12-27-06 1:09

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Time traveller and Redstone check out mta.org Thats how u build up up ur resume to Wall St. It would be nice to have a trading room in ktm or thamel or even durbar marg and trade the Londong hrs.

|

| |

|

|

Samsara

Please log in to subscribe to Samsara's postings.

Posted on 12-27-06 6:17

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Timetraveller, Your analysis was way off the mark. I am a guy (whatever made you think I was not? A lot of Buddhist names can apply to both sexes: Sonam, Tashi, Karma, etc.)...BTW, Samsara is just a pseudonym. Great seeing an increased activity in this thread. I only log in during wkdays when bored at work (eg: the year end days)...Looks like we've totally strayed off the topic here. All the best in your trading folks!!

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-27-06 6:22

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Historically, Small caps have done really well the last few days of the year. Will it hold true again this year? I am taking rest of the year off. Will be back in 2007.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-27-06 9:38

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Eminitrader, are you a professional or did u learn these on your own? Either way it's very impressive that you and others are involved in this investment/trading business. Was wondering if mama's stock is going to rebound. Looks like it's just going through a cover for it's short sells these past few days. TT

|

| |

|

|

Samsara

Please log in to subscribe to Samsara's postings.

Posted on 12-27-06 10:14

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Seems to me that he knows the ins and the outs of the biz...Really impressive that there are other Neps into the same profession and KNOW what they're doing. Anyone trading FX Options there?? Would love to hear your experiences.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-27-06 10:45

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I'm a kid. lol. I'm just glad I'm talking to some actual traders here. One thing we gotta make sure is NOT to make this a hype-up forum. And lets not have the more knowledgeable ones show off their wits and start making bets see who's bettuh. Just knowledge and discussions about the markets. Nepalis are some of the most risk averse people on the planet. Partly dude to the current economic and social situation. I think these kinds of threads help people get out of their shell become more entrepreneurial in their goal towards financial independence. I'm enjoying the stimulating conversation so far.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-27-06 10:49

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Oh and sorry Samsara. It's just that somebody I knew (and she was Indian) had the same name. I used to be friends with Tashi, Sonam, Lakpa and others in Nepal. So I totally nderstand what you mean. Thanks for the clarification. But it would still be better if women got interested in this. Just imagne wouldn't it be an awesome way for stay home mums lookin after kids to make an extra income? There comes a time in every woman's life when she has to stay at home doing NOTHING. But most Nepali girls choose Engineering, Doctor, nursing or other vocations- very risk averse. How chweet. TT

|

| |

|

|

Samsara

Please log in to subscribe to Samsara's postings.

Posted on 12-27-06 11:19

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Timetraveller, I only wish I had taken some time to learn these when I was in college. It took me scores of books to finally know what I was doing (Cornelius Luca was da man then!!). These days, I see all the trading educational websites and wonder where they were back in 2000 / 2001. Also, you're fortunate that you have a few ppl here who really know their sh*t and could explain all the technical analysis stuff which academia considers to be BS. As for the Risk averse statement, you're talking to one wrong Nepali. I have betted the ranch a few times on specific occasions when I just had the slightest hunch that there was no way my analysis would fail. One time, overlooked some fundamentals and ended up getting burnt totally. On the flip side, made a considerable amount another time...But, overall, as I have learnt so far your losses make you a better trader (if you understand what you did wrong and try to minimize its chances/loss amount the next time around). BTW, Are you actively trading? If so what (equities, FX, bonds, etc.)?

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-27-06 12:27

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I'm going to start my own thread and answer all your questions. Not trading much today. I'm long 1 SP-mini from 1432.75, I think the market will rally after lunch. I posted my P&L statement, not to show off but just because I wanted people to take me seriously. If I had come and said that I made so much money on 1 day, people would not have believed me, so the P&L. I won't post that again unless I have a really really big day. Please learn the basic market terms like limit order, stop-loss, market order, difference between futures and stocks and as such. I am not going to discuss these terms but strategies only.

|

| |

|

|

Bricolage

Please log in to subscribe to Bricolage's postings.

Posted on 12-27-06 1:34

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

eminittrader, badhai cha on a bullish day you had. I shall look forward to your thread come 2007. -B

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-27-06 3:02

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Nice rally after lunch. Made 4.25 ES points.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-27-06 11:56

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Samsara, I think I'm getting a good grasp on equties. I believe by the time I get out of school I should get a decent position in a firm and not have much trouble learning. But my focus is on other exotic things. I like derivatives. I took a course in Derivatives pricing and it turned out to be boring long calculations and deriving the BS BS formula. (First BS for bullshit, the second one for Black Scholes). We had two pages on notes on a few trading stragies....and period! I can't see how in today's sophisticated markets, one could rely on the BS formula. Especially since everyone has access to it in freakin EXCEL! So I've decided to quit an academic career as a quant. instead I wanna focus on using these models developed by quants. Investment banking seems a lot of hours for the same pay as a trader (can someone confirm that?). except traders i heard go through more stress in that short time. So anyways, my focus is derivatives and forex and futures- diversifying. And I need to start shorting. I've lost more than gained and I'm happy I see it as a positive sign. I can;t believe I'm learning so much. Especially when aftermarket hours are also being more liquid one cannot afford to be an investor like buffett- buy and hold. I'd rather be a Pirhana than a Whale. We need to acknowledge that these are fast times. Like someone posted in a nother thread- even buffett trades currencies and is betting the USD will go down. And totally agree with eminitrader and Jhalincha's posts. Ghati heri haad nilnuparcha. But then again, if you're young like me- i say go for it. If you lose everything you have, go back to McDonalds and Best Buy, work it off before you leave school and get back at it again. Don't quit. Trader's aren't born- they're made. A good example? Chrles Schwab- he couldn;t even read properly when he was young. And look at him now- need I say more? "Life's either a daring adventure or nothing"- Helen Keller. I live every trading day by that motto! KI KASO????

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-28-06 12:03

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

A question before I head to bed: How do you figure out those market maker tactics on the L2 screen? Sometimes it's kinda obvious- the rest of the time it frustrates the crap out of me. I don't expect your secrets just some ideas or links to sites with such ideas would suffice. Thanks- that's one of my last steps in conquering "knowledge" on equities.

|

| |